What is CBDC ?

A CBDC (Central Bank Digital Currency) is essentially a digital version of a country’s fiat currency, issued and backed by the central bank. It can be used for electronic payments and can be exchanged for physical currency. It is different from cryptocurrencies like Bitcoin and Ethereum in that it is issued and backed by a central authority, and its value is tied to the country’s fiat currency. The purpose of CBDC is to provide a secure and efficient means of digital payment, and to give central banks more control over monetary policy.

One of the main benefits of CBDCs is that they can potentially increase financial inclusion. Traditional banking systems can be difficult for people in developing countries to access, and many are unbanked or underbanked. A CBDC could provide a way for these people to access digital financial services without needing to go through traditional banks. Additionally, CBDCs can potentially increase efficiency and reduce costs associated with cash transactions.

CBDCs can also provide a new tool for central banks to carry out monetary policy. For example, a CBDC could be used to implement negative interest rates, which is a monetary policy tool where the central bank charges a fee on deposits in order to encourage borrowing and spending. This is a tool that is currently not possible with traditional banking systems.

Features of CBDC

- CBDC is sovereign currency issued by Central Banks in alignment with their monetary policy

- It appears as a liability on the central bank’s balance sheet

- Must be accepted as a medium of payment, legal tender, and a safe store of value by all citizens, enterprises, and government agencies.

- Freely convertible against commercial bank money and cash

- Fungible legal tender for which holders need not have a bank account

- Expected to lower the cost of issuance of money and transactions

NPCI

The National Payments Corporation of India (NPCI) is a not-for-profit organization that was set up by the Reserve Bank of India (RBI) and Indian Banks’ Association (IBA) with the goal of managing and promoting retail payment systems in India. NPCI’s mission is to enable all forms of electronic payments and promote financial inclusion in the country. This organization is playing a crucial role in the government’s Digital India initiative by providing a safe, secure, and efficient infrastructure for digital transactions.

Some of the key services offered by NPCI include:

- Unified Payments Interface (UPI): a real-time, 24×7, inter-bank electronic fund transfer service that enables instant fund transfer between two bank accounts on a mobile platform.

- Immediate Payment Service (IMPS): enables instant inter-bank fund transfer 24×7.

- National Electronic Funds Transfer (NEFT): enables the transfer of funds between banks across the country on a deferred settlement basis.

- Real Time Gross Settlement (RTGS): a high-value electronic funds transfer system that enables real-time transfer of funds between banks.

- National Automated Clearing House (NACH): enables electronic clearance of bulk transactions.

- Bharat Bill Payment System (BBPS): a one-stop bill payment system that enables consumers to pay multiple bills through a single platform.

All these services are aimed to provide a safe, secure, and efficient infrastructure for digital transactions and promote financial inclusion in India.

Similarly, The National Payment Corporation of India created the e rupi digital payment system on the UPI platform. The national payment corporation of India has boarded banks that will be the voucher’s issuing authority. The corporation or government agency must contact the partner bank (private and public sector lenders) with the exact person and purpose for which the payment is required. Beneficiaries will be identified using the mobile number vouchers provided by the bank. This platform will be a ground-breaking digital effort, aimed at raising living standards and simplifying payment procedures.

e RUPI

What is e rupi ?

Prime Minister Narendra Modi, will unveil the e rupi Digital Platform, a digital payment platform. This platform will be used to make digital payments and is cashless and contactless. It is a QR code or SMS string-based e-voucher that will be given to the consumers’ mobile phones. This coupon can be used without the need of a digital payment app, internet banking, or a card. The national payments corporation of India created this digital payment solution e-rupi mechanism on its UPI platform.

The payment to the service provider will be paid only when the transaction is completed through the e rupi platform. This payment platform will be prepaid, thus there will be no need for a middleman to make payment to the service provider. Aside from that, this platform can be used to deliver services under schemes that provide drugs and nutritional support, such as the mother and child welfare scheme, the tuberculosis eradication programme, drug and diagnostic services under the Ayushmann Bharat Pradhan Mantri Jan Arogya Yojana, fertilizer subsidies, and so on. These digital tokens can also be used by the commercial sector for employee welfare and corporate social responsibility projects. This programmed will provide leak-proof innovative delivery of social services.

The Goal of e RUPI Digital Payment

The major goal of the e rupi digital payment platform is to establish a cashless and contactless payment system so that citizens may easily make digital payments. Users may make safe payments with the aid of this payment platform. This payment mechanism employs a QR code or SMS string-based e rupi vouchers that is transmitted to the beneficiary’s mobile phone. The e rupi vouchers digital payment platform guarantees that services are paid on time without the participation of a middleman. Users will not need to carry any cards, digital payment apps, or internet banking access to make payments, making the payment process easy and safe.

Working system of e rupi–

- First, the issuer sends the recipient an e rupi voucher. The bank will also block the issuer’s funds.

- The voucher will be delivered to the recipient through SMS or QR code.

- To get the stated benefits, the beneficiary must present the service provider the e-RUPI voucher received through SMS or QR code.

- After validating the e rupi voucher, the service provider will offer the selected service to the recipient.

- Following the conclusion of the transaction, the issuer’s blocked funds will be transferred to the service provider

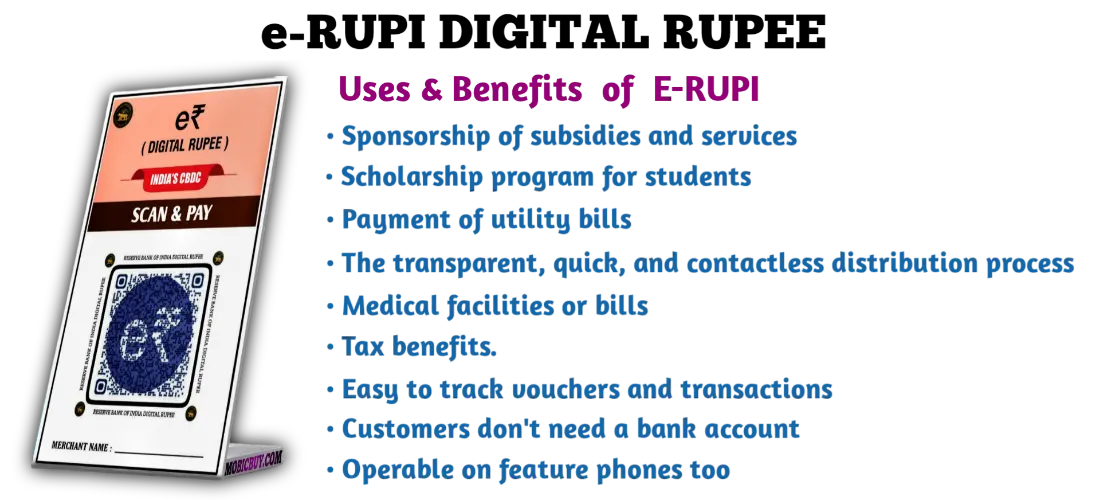

The Advantages of e rupi-

- It is a cashless and contactless digital payment tool.

- The coupon is delivered to the recipient through SMS or QR code. As a result, the recipient does not need a bank account, internet access, or online banking, among other things.

- The benefit is available solely to the individual person and for the pre-defined specific purpose. As a result, it strengthens ‘Direct-Benefit Transfer’ and makes transactions more transparent.

- e rupi is compatible with any basic phone. The recipient is not required to have a smartphone or access to the internet.

- Its unique characteristics enable the leak-proof delivery of any social services.

Procedure for Issuing Vouchers

The national payment corporation of India has boarded banks that will be the voucher’s issuing authority. The corporation or government agency must contact the partner bank (private and public sector lenders) with the exact person and purpose for which the payment is required. Beneficiaries will be identified using the mobile number vouchers provided by the bank. This platform will be a ground-breaking digital effort, aimed at raising living standards and simplifying payment procedures.

Banks that issue e RUPI-

Following banks partners e-RUPI transactions-

- HDFC Bank,

- Canara Bank,

- Axis Bank,

- Kotak Mahindra Bank,

- Bank of Baroda,

- Indian Bank,

- ICICI Bank,

- State Bank of India,

- IndusInd Bank

- Punjab National Bank, and

- Union Bank of India.

Procedure To Redeem e-RUPI Voucher

- At the service provider outlet, the recipient must provide the e-RUPI QR code or SMS.

- This QR code or SMS must be scanned by the salesperson.

- Now, an OTP will be sent to the recipient.

- The recipient must submit this OTP to the service provider.

- This OTP must be entered into the OTP box by the service provider.

- Now the service provider must click the Proceed button. Payment will be sent to the service provider.

PERFECT